Bptp Princess Park Faridabad

Bptp Princess Park is the first group housing project of BPTP Ltd. which is a part of Project Parklands.It is spread over approximately 17.97 acres of land and 12 towers of 14 to 19 floors each. It will comprise apartments with provision for 100% power backup, 24x7 security, swimming pool, a sports or recreational club and landscaped areas. This project is designed by the architect C.P. Kukreja and Associates. It gives choices of 2bhk ( 2 bedroom ), 2+1bhk ( 2 bedroom with study room ), 3 + 1bhk ( 3 bedroom + servant ) & 3 + 1 + 1 bhk ( 3 bedroom + study + servant ) apartment.

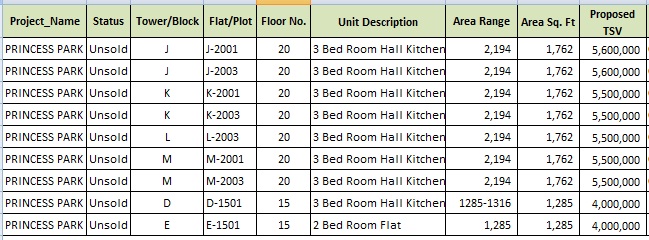

Fresh Booking in Bptp Princess Park Faridabad

Location: Sector 86, Parklands

Plot Area: 17.97 Acres

Towers: 12 Towers of 14 to 19 Floors

Architect: C. P. Kukreja & Associates

| Type | Size | BHK | Price | Total Cost |

|---|---|---|---|---|

| Residential Apartments | 1305 sq. ft. | 2 BR | 40-47 Lacs | Ask For Details |

| Residential Apartments | 1422 sq. ft. | 2BR + STUDY | 50-55 Lacs | Ask For Details |

| Residential Apartments | 1697 sq. ft. | 3 BR | 58-65 Lacs | Ask For Details |

| Residential Apartments | 1857 sq. ft. | 3 BR + SERVANT | 60-68 Lacs | Ask For Details |

| Residential Apartments | 1811 sq. ft. | 3 BR + STUDY | 65-75 Lacs | Ask For Details |

| Residential Apartments | 2023 sq. ft. | 3 BR + SERVANT + STUDY | 71-80 Lacs | Ask For Details |

Price of Bptp Princess Park Faridabad When Project Launched

| Particulars | 2br | 2br+study | 3br | 3br+ser | 3br+study | ||

| 1305 sqft | 1422 sqft | 1697 sqft | 1857 sqft | 1811 sqft | 2023 sqft | ||

| BSP (@ Rs.1400/- per square feet) | 1827000 | 1990800 | 2375800 | 2599800 | 2535400 | 2832200 | |

| EDC & IDC (@ Rs.305/- per square feet) | 398025 | 433710 | 517585 | 566385 | 552355 | 617015 | |

| Car parking | 150000 | 150000 | 150000 | 150000 | 150000 | 150000 | |

| Power backup + FFC (@ Rs.200/- per square feet) | 261000 | 284400 | 339400 | 371400 | 362200 | 404600 | |

| IFMS charges(@ Rs.50/- per square feet) | 65250 | 71100 | 84850 | 92850 | 90550 | 101150 | |

| Club membership | 40000 | 40000 | 40000 | 40000 | 40000 | 40000 | |

| Total without any plc's | 2741275/- | 2970010/- | 3507635/- | 3820435/- | 3730505/- | 4144965/- | |

| OTHER CHARGES | |||||||

| PLC'S:- 5%, 4%, 3% of BSP ON Ground, Ist, 2nd | |||||||

| Park facing (@ Rs.100/- per square feet) | 130500 | 142200 | 169700 | 185700 | 181100 | 202300 | |

| Transfer charges(@ Rs.25/- per square feet) | 32625 | 35550 | 41425 | 46425 | 45275 | 50575 | |

| PREMIUM AS PER THE MARKET | |||||||

DOCUMENTS REQUIRED FOR HOME LOAN ARE

FOR SALARIED INDIVIDUALS

- Salary slip/Form 16 A.

- A photocopy of the first and last pages of Ration card or copy of PAN/Telephone/Electricity bills.

- A photocopy of Investments (FD Certificates, Shares, any fixed asset etc. or any other documents

supporting the financial background of the borrower. - A photocopy of LIC policies with the latest premium payment receipts (if any).

- Photographs (as applicable).

- A photocopy of bank statement for the last six months.

FOR SELF EMPLOYED OR BUSINESS MAN

- A brief introduction of Business/Profession.

- Balance Sheet, Profit and Loss account and statement of income with Income Tax returns for the last 3 years certified by a CA.

- A photocopy of Advance Tax payments (if applicable).

- A photocopy of Registration Certificate of estatblishment under shops and Establishments Act/Factories Act.

- A photocopy of Registration Certificate for deduction of Profession Tax (if applicable).

- Bank statements of Current and Saving accounts for the last 6 months.

- A photocopy of Certificate of Practice(if applicable).

- A photocopy of any bank loan (if applicable).

- A photocopy of the first and last pages of the Ration card or a copy of PAN/Telephone/Electricity Bills.

- A photocopy of LIC policy (if applicable).

- A photocopy of investments (FD Certificates, Shares, any other fixed asset).

FINANCE OPTIONS

| PUNJAB NATIONAL BANK | PNB Housing Finance Ltd. | LIC Housing Finance Ltd. |

| BHW Birla Home Finance Ltd. | Axis Bank | Indian Bank |

| HDFC Bank | Union Bank of India | Central Bank of India |

| Indian Overseas Bank | Oriental Bank Of Commerce | |

| Bank of Maharashtra | India Bulls Housing Finance Ltd. |

FOR NRI INVESTORS IN INDIA

BPTP is committed to providing safe investment opportunities for the NRI community and ensuring they stay connected to the homeland.

Leveraging the Boom in Real Estate

The Indian real estate sector has witnessed a revolution, driven by the booming economy, favourable demographics and liberalised foreign direct investment (FDI) regime. It has emerged as one of the most appealing investment areas for domestic as well as foreign investors. As incomes grow, and retail makes inroads, shopping malls and multiplexes, luxury and budget hotels, resorts and serviced apartments, residential townships and condominiums, IT Parks and Special Economic Zones are not the exclusive preserve of Tier I cities like Delhi, Mumbai, Bangalore, Hyderabad and Chennai anymore.

Inviting Global Attention

As the Indian Government allowed the foreign direct investment in real estate, host of investors have shown confidence in the enormous potential of the real estate market in India. The global real-estate consulting group Knight Frank has ranked India 5th in the list of 30 emerging retail markets and predicted an impressive 20 per cent growth rate for the organized retail segment by 2010. Supported by infrastructure development, contemporary architecture and state-of-the art facilities in aesthetically designed environs, India's real estate has much to offer to the NRIs.

NRI Investment in Real Estate

All persons residing outside India holding Indian passports and also people of Indian origin have been granted permission by the Reserve Bank of India (RBI) to invest in both residential and commercial properties in India. To an NRI, a base in the homeland also brings with it a sense of security. The number of NRIs who are investing in property for sentimental reasons and for better investment returns is quickly multiplying. The NRI investor can raise finances from financial institutions to purchase a property. Banks and other financial institutions in India are facilitating the NRI investment in property quickly and efficiently. Future Ahead With the economy surging ahead, the demand for all segments of the real estate sector is likely to continue to grow. The Indian real estate industry is likely to grow from US$ 12 billion in 2005 to US$ 90 billion in by 2015. Given the boom in residential housing, IT, ITeS, organised retail and hospitality industries, this industry is likely to see increased investment activity. Foreign direct investment alone might see a close to six-fold jump to US$ 30 billion over the next 10 years. And that makes India a haven for NRI investments (source: indiaground.com).

Investing in BPTP

For payments from accounts outside India Please make wire transfers in USD

NRI FAQS

Procedure For Applying Online for NRIs

In order to facilitate easy bookings of properties residential or commercial for NRIs, BPTP has uploaded the PDF format of application forms for each project so that one could easily apply online. The information asked is easy to understand and requires to be filled in by the applicants. Along with the application, one needs to provide his/her photograph, Address Proof, copy of Passport and PAN card. In case your income is not taxable in India, a plain declaration through a mail could be sent to the marketing representative of the organization with whom the applicant is in touch with, stating that his/her income is not taxable in India. Once all these requisites are completed, the same could be sent online and the Booking Amount, which is normally 10% of the BSP, could be remitted online in the company?s account. The details of company?s bank account would be furnished by the market representative online itself. After remitting the stated amount, the receipt of the remittance needs to be sent to the same market representative for records and easy transaction. Once the money is remitted and deposited in account, the company issues the official receipt and the application for booking the property is logged in. After we login the application for booking, all the necessary information about allotment, signing of agreements, construction updates, demand letters, receipts etc. are sent regularly at the email address mentioned in the application form, which is mandatory for every applicant in BPTP. General Guidelines for NRIs and PIOs for Purchasing Property in India

General Guidelines for NRIs and PIOs for Purchasing Property in India

| Types | Residential Purpose | Commercial Purpose | Funds for Investment in Property | Letting out of Property | Proceeds Repatriable/Non Repatriable |

| Non Resident Indian | No RBI Approval required | No RBI Approval required |

a) Direct remittance NRO/NRE A/C b) Loans against NRE/FCNR Deposits for Residential House only b) Loans against NRE/FCNR Deposits for Residential House only |

No RBI approval required | Repatriation of Sale Proceeds equivalent to the Original Investment is permitted for a maximum of two houses as well as Commercial Property after 3 years of acquisition (i.e. possession) or payment of last installment, whichever is later, provided the investment is out of direct remittance or NRE/FCNR account. Form IPI - 8 is to be submitted to RBI within 90 days of sale of the property. |

| Foreign citizen of Indian origin | No prior RBI approval, only intimation to RBI in Form IPI - 7 within 90 days of purchase (Press Release dated 8/1/1992). | No RBI approval required. Intimation to RBI in Form IPI - 7 within 90 days of purchase (08/06/93 Circular). |

a) Out of NRE/FCNR A/C or Foreign remittance b) Loans against NRE/ FCNR Deposits for Residential House only c) With prior approval of RBI from NRO Account |

No RBI approval required | Repatriation of Sale Proceeds equivalent to the Original Investment is permitted for a maximum of two houses as well as Commercial Property after 3 years of acquisition (i.e. possession) or payment of last installment, whichever is later, provided the investment is out of direct remittance or NRE/FCNR account. Form IPI - 8 is to be submitted to RBI within 90 days of sale of the property. |

| Non Citizens of Foreign Origin i.e. Foreigners | RBI approval required (Circular dated 23/3/1992) | RBI approval required | Direct remittance | RBI approval required (Circular dated 23/3/1992) | Non Repatriable |

| OCB | |||||

|

a) Controlled by NRI 60% b) Others |

a) RBI approval required b) RBI approval required |

a) RBI approval required b) RBI approval required |

a) Direct remittance b) Direct remittance |

a) No RBI approval required b) No RBI approval required |

a) Non Repatriable b) Non Repatriable |

| FERA Companies | No RBI approval required (FERA 104/92-RB Dated 29/1/92) | No RBI approval required | Direct remittance | No RBI approval (Circular Dated 23/3/1992) | Non Repatriable |

BPTP PRINCESS PARK FARIDABAD AT SECTOR 86